Source: Philam Life Insurance

Step 1: Sign up for a virtual meeting

The best thing about buying Philamlife Insurance is that you need not physically meet with your Philamlife Financial Advisor just to buy life insurance. You can buy life insurance within the comfort of your homes.

You can choose to meet with your Philamlife Financial Advisor at any of these online meeting platforms. These are some of the virtual meeting platforms that you can utilize. Microsoft Teams, zoom, googlemeet, messenger and skype. All of these platforms are free and downloadable to your googleplay and apple store.

Step 2: Share details to a Financial Advisor

Remember: "Your policy is a plan for yourself and your family. Make sure that when you buy life insurance, see to it that your goals are met. You are the boss. State your goals to your Philam Life Financial Advisor, let him present to you that perfect plan that will maximize your hard-earned income."

This will take only one (1) to two (2) hours of your precious time. Make sure that you provide all the required personal information needed to get your Philam Life Insurance approved. You will share the following personal information to your Philamlife Financial Advisor: personal information, name of beneficiaries, source of income, and even your educational background.

After submission of the required information with your Philamlife Financial Advisor, you will receive an SMS/text message from Philamlife Insurance showing you the contents of your life insurance policy. You will be required to sign your signature on your cell phone in your online policy to make it binding. You are also required to take a picture of at least two (2) valid government IDs as proof. You will need an internet connection to perform this procedure.

After finishing the said steps, press the send button. This will prompt your data to be submitted to your Philamlife Financial Advisor who will now process your Philam Life life insurance.

At the end of Step 2, your Philamlife Financial Advisor will send you a Philam Life Account Number/Policy Number which will be needed in the final step to finish your application.

Step 3: Pay via online payment

Use the 10 digit Philamlife Policy Account Number/Policy Number that was given to you by your Philamlife Financial Advisor to pay your life insurance policy application. You can deposit your payment to any of the following payment partners of Philam Life which include Bank of Philippine Islands (BPI), Banco De Oro (BDO), Metrobank, Union Bank, Eastwest Bank, China Bank Savings (CBS), Philippine National Bank (PNB), Security Bank (SB), Bayad Center, M Lhuillier and Gcash payment.

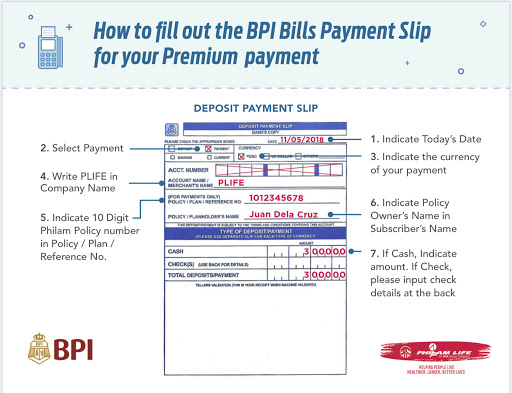

For reference, see this payment sample for BPI Bank.

Source: Philam Life Insurance

Approval of the Philamlife Insurance policy

Once payment is done, your documents will be reviewed by the Underwriter. The industry standard is about seven to 14 days to as long as a month. The good news about Philamlife insurance, your policy application may be approved as fast as one day. Provided that your documents are all compliant to company standards.

Book my services as Financial Advisor.

If you think that the contents of this article helped you in any way. I would appreciate it if you can comment and share my blog with your social media pages, especially with your friends, family, and colleagues. Thank you.

You can reach me out on the following social media:

Linked-in: Efraim Osingat, CPA, MBA, RFP

FB Page: Financial Literacy Evolution

FB Group: Philam Life Insurance, Local/Global Stock Market and Mutual Funds

Website: beacons.ai/efprimefinance

Youtube: EfPrime Finance

All Rights Reserved.

Disclaimer

The Author is advising readers to consult with your respective Financial Advisors before venturing in any investments. Investing your money is dependent to your goals and your risk tolerance. You should know the risks and rewards of investing before you actually do the same. The illustrations above are for educational purposes only and any risks or losses that you may incur are imputable to your respective decisions.

The author does not in any way provide a guaranty as to the effectiveness and quality of the products and services that are featured in this blog. The products and services were advertised based on personal experience and product and service reviews that the product/service received.

Subscribe to my newsletter and I’ll send you the things that we’ll both love. Just put your information and you’ll be all set. And as always, feel free to unsubscribe or adjust the frequency of mailings.

Subscribe to our Newsletter: Sign up Here

Comments

Post a Comment